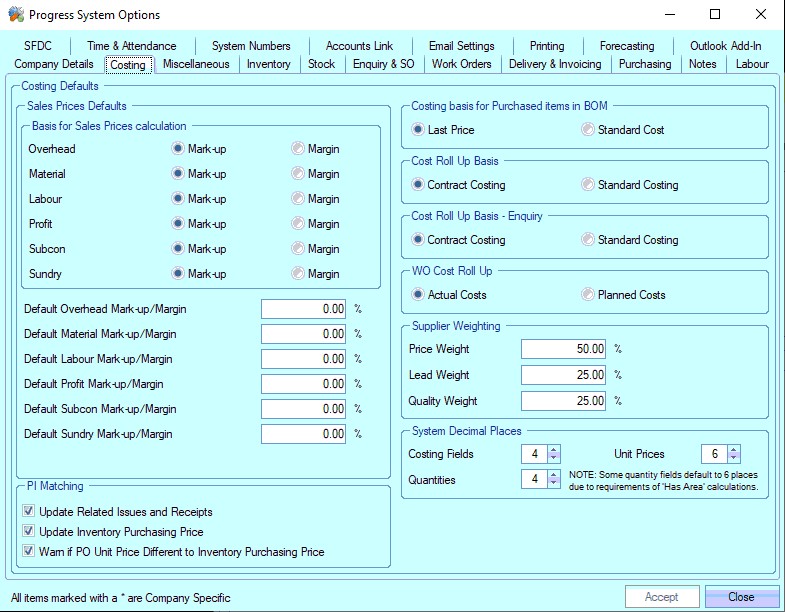

These options relate to the costing methods used by the system for cost roll up, default margins and mark-ups as well as PI matching rules.

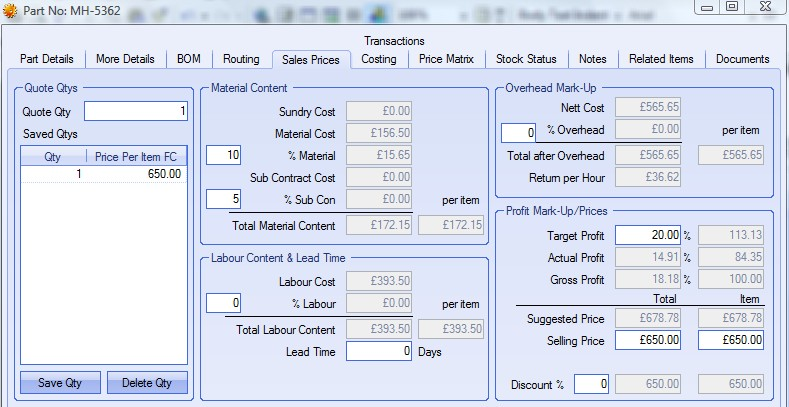

This screen permits the administrator to enter default percentage mark-ups that are used in the Enquiry section of progress plus within the Customers area. These fields are in the Enquiry Sales Prices form as shown in the following example.

The default mark-ups / margins entered in this form can be amended by the user on a quote by quote or even a quantity by quantity basis when entering enquiries. Customers can also have their own mark-ups entered within the system against the customer record. Any customer specific mark-ups / margins will take preference over any system default mark-ups / margins entered into this form.

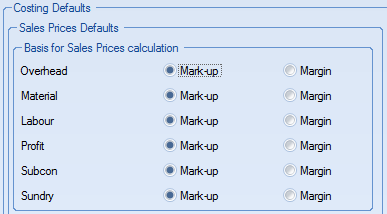

Sales Prices Defaults

Basis for Sales Prices calculation

Ticking either Mark-up or Margin on each type of costing dictates how prices are calculated in the Sales Prices screen for Enquiries. Mark-up puts a percentage increase on the cost price, whereas Margin puts a percentage increase on the selling price. The two methods can be mixed as required. Please refer to the following examples.

Basic Difference between Mark-Up and Margin

Item Cost = £100 20% Mark-Up applied £100 + (£100 x 20%) Total = £120

Item Cost = £100 20% Margin applied £100 / (£100 – 20%) +£100 Total = £125

20%

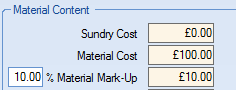

If ‘Mark-up’ is used this will have the following effect on the Enquiry Sales Price screen when quoting.

Example

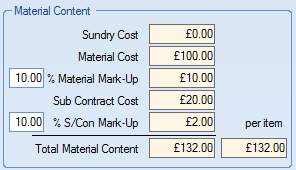

The Material Cost is £100 from the BOM, the mark-up is 10%, adding £10 (£100 x 10%), and therefore the total Material Content would be £110

Subcontract costs are £20 from the Routing, the mark-up is 10%, adding £2 (£20 x 10%), and therefore the total subcontract content would be £22

![]()

Combining the material and subcontract content along with any mark-up would produce a Total Material Content for the item as displayed below.

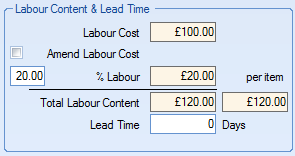

The mark-up applied to labour operations works in a similar way.

Labour costs are £100 from the Routing, the mark-up is 20%, adding £20 (£100 x 20%), and therefore the total labour content would be £120

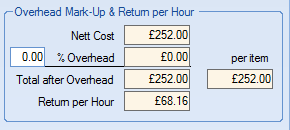

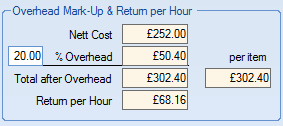

Overhead mark-ups can also be applied to the total combined costs of material, subcontract and labour along with any mark-ups previously applied.

The total Nett Cost of material, subcontract and labour are £252, therefore with an additional 20% mark-up to allow for Overhead Mark-Up would add £50.40 (£252 x 20%), and the new total would be £302.40

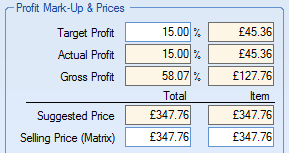

A further Profit margin can be applied to the Total after Overhead figure if an additional mark-up is required. Including the previous mark-ups the Suggested Price would be £302.40, however adding additional profit at 15% mark-up would add £45.36 (£302.40 x 15%), to give a Suggested Price of £347.76.

Users must be careful not to apply mark-ups to too many fields as this will greatly inflate the final Suggested Price.

If ‘Margin’ is used this will have the following effect on the Enquiry Sales Price screen when quoting.

Example

The Material Cost is £100 from the BOM, the margin is 10%, and therefore the total Material Content would be £111.11. e.g. £100 / (1 - 0.1) = £111.11.

![]()

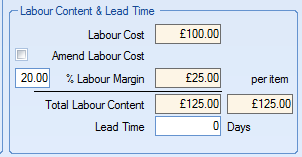

Labour Cost is £100 from the Routing, the margin is 20%, and therefore the Total Labour Content would be £125. e.g. £100 / (1 – 0.2) = £125.

The process of applying a margin to the other fields such as Sub Contract cost, Overhead Margin, Profit Margin etc. will work in a similar fashion to that previously described when applying mark-ups to these areas.

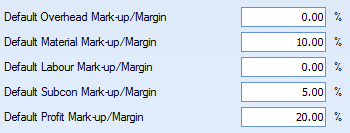

Default Overhead Mark-up/Margin

This field permits the administrator to enter a default mark-up to the overheads content of the item (the cost of the operations on the routing and the items on the BOM by a desired percentage). On initial entry of a quote this default % figure will used as the overhead mark-up % unless there is a specific mark-up held against the customer record. Please refer to Customer: Defaults for more information.

Default Material Mark-up/Margin

This field permits the administrator to enter a default mark-up to the total material content of the item (the cost of parts on the BOM, sundry and subcontract costs) by a desired percentage. On initial entry of a quote this default % figure will used as the material mark-up % unless there is a specific mark-up held against the customer record. Please refer to Customer: Defaults for more information.

Default Labour Mark-up/Margin

This field permits the administrator to enter a default mark-up to the labour content of the item (the cost of the operations on the routing) by a desired percentage. On initial entry of a quote this default % figure will used as the labour mark-up % unless there is a specific mark-up held against the customer record. Please refer to Customer: Defaults for more information.

Default Profit Mark-up

This field permits the user to mark-up the target profit of the item (the cost of the operations on the routing + the cost of the parts on the BOM + any overhead mark-up) by a desired percentage. On initial entry of a quote this default % figure will used as the profit mark-up % unless there is a specific mark-up held against the customer record. Please refer to Customer: Defaults for more information.

Default Subcon Mark-up/Margin

This field permits the administrator to enter a default mark-up to the subcon content of the item (the cost of the subcontract operations on the routing) by a desired percentage. On initial entry of a quote this default % figure will used as the subcontract mark-up % unless there is a specific mark-up held against the customer record. Please refer to Customer: Defaults for more information.

The next four options deal with the way material and costs are calculated within Progress Plus.

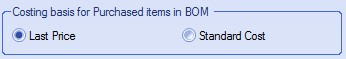

Costing Basis for Purchased Items in BOM

This field permits the administrator to determine in what manner the planned costs for bills of materials are calculated within the inventory record.

Last Price

Progress Plus will use the last price (Purchasing Cost) for a purchased part as held in the Costing section for the item within Inventory. The Purchasing Cost can either be a manually entered field or the information can be updated from the Purchase Invoice Matching option. Using last prices means that the system will always pick up the last price paid for the item, though the price could be out of date if the item has not been purchased for a while. Items that have a supplier price matrix for a part will take preference over the Purchasing Cost held for the item.

Standard Cost

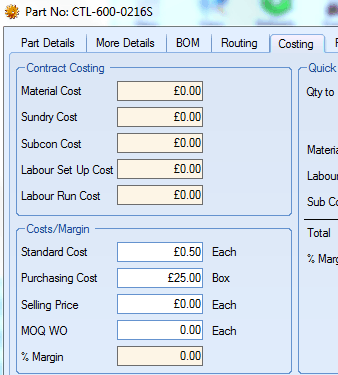

Progress Plus will use the standard cost for a purchased part as held in the Costing section for the item within Inventory. This is the price that the administrator always wants to cost this item at. This may be equal to, greater than or less than the Purchasing Cost divided by the Conversion Qty for the item e.g.

Example

Some screws are purchased by the box. There are 50 screws in the box. The cost is £25 per box

Unit Of Measurement (UOM) = Each Unit Of Purchase (UOP) = Box Conversion = 50

On entering the Purchasing Cost when creating these screws in the Inventory system progress plus would allocate a Standard Cost of £0.50 per UOM (UOP Cost / Conversion Qty = £25/50). After the Standard Cost has been saved this figure can be adjusted manually if required as it is not updated from Purchase Invoice Matching.

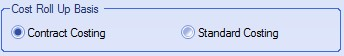

Cost Roll Up Basis

This field permits the administrator to determine in what manner the planned costs for bills of materials and routings are calculated within Inventory and Enquires for multi-level assembly items. The main difference is in the manner that set-up is calculated for lower level items and MOQ quantities for parts, both manufactured and purchased.

e.g.

Part A is an item that has been manufactured from joining Part B and Part C together at a labour run cost of £15

Part C is a purchased part that costs £10 each

Part B is a manufactured part that has a material cost of £20, a setup cost of £30 and a run cost of £20 per item. Part B is normally manufactured in batches of 10

Contract Costing

This option works on the total cost to manufacture 1 item – regardless of how lower level items are manufactured. Using the above example the cost for Part A would be £95

£15 + £10 + £20 + £30 + £20 = £95

Part A Labour Part C Material Part B Material Part B Setup Part B Run

Standard Costing

This option works on the cost to manufacture an item but takes into consideration any batch quantities used on lower level assemblies/purchased parts. Using the above example the cost for Part A is

£15 + £10 + £20 + £3 + £20 = £68

Part A Labour Part C Material Part B Material Part B Setup Part B Run

(£30 / 10)

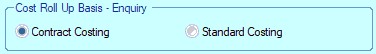

Cost Roll Up Basis - Enquiry

This option allows the administrator to determine whether the enquiry costing process used on the inventory Sales Prices tab is Contract Costing or Standard Costing. Same processes as above Cost Roll Up, but allows enquiry costing process to be set differently if preferred.

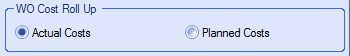

WO Cost Roll Up

This field permits the administrator to determine in what manner works order costs for reporting purposes are attributed.

Actual Costs

This option picks up the actual batch costs of any items issued to a works order. Using Actual Costs will help to highlight cost differences between when comparing planned material, labour and sub contract costs with those that were actually achieved. This option will give a truer idea of how we performed on a job.

Planned Costs

This option uses the planned costs for the works order as the actual cost.

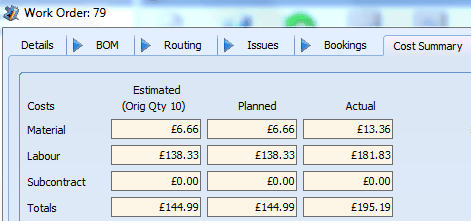

The following screen shot details the Actual costs of Material, Labour and Subcontract incurred against a works order when using the Actual Costs option.

Using the Planned Costs option the figures displayed in the Actual totals would match those in the Planned totals.

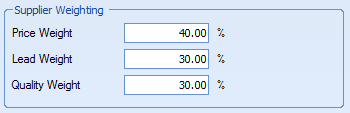

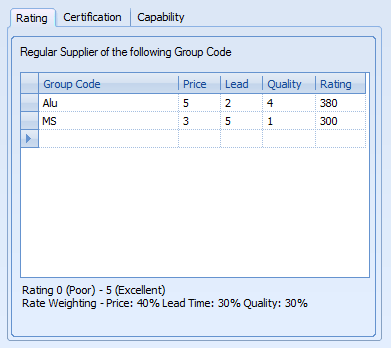

Supplier Weighting

This section allows the administrator to set the company’s priorities when selecting suitable suppliers for particular products and is directly related to the Rating tab found in Supplier: Defaults.

For each of the product groups each supplier supplies to, a rating of 1-5 can be set against Price, Lead Time and Quality. To calculate the overall Rating each Group Code rating is multiplied by the relevant Supplier Weightings and then totalled. For example, based on above settings.

Alu (Aluminium) Group Code

Price has rating of 5 x Price Weighting of 40% = 200

Lead has rating of 2 x Lead Weighting of 30% = 60

Quality has rating of 4 x Quality Weighting of 30% = £120 => Overall Rating of 380

MS (Mild Steel) Group Code

Price has rating of 3 x Price Weighting of 40% = 120

Lead has rating of 5 x Lead Weighting of 30% = 150

Quality has rating of 1 x Quality Weighting of 30% = 30 => Overall Rating of 300

After the administrator has completed any changes clicking the Accept button on the bottom of the form will save the updated information.

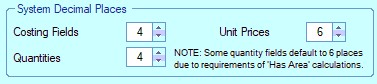

System Decimal Places

This section allows the administrator to set the number of decimal places that are displayed in various areas of the system.

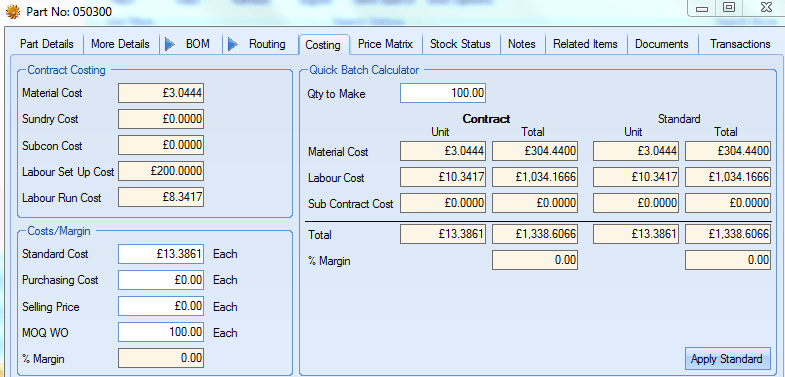

| Costing Fields | This setting will determine how information regarding costs is displayed in forms such as the Costings screen in Inventory. In the following example the Costings Fields have been set to 4 decimal places. |

Please note that when calculating costs the system will automatically calculate to 6 decimal places but will only display information to the desired number of places e.g.

- Part cost has been calculated by the system as 0.123456

- If the system is set up display 4 decimal places the system would show 0.1235 as the cost

- Changing the system to display 2 decimal places would result in a cost of 0.12 being shown

The number of decimal places in the Costing Fields also applies when creating a BOM (Bill of Material)

![]()

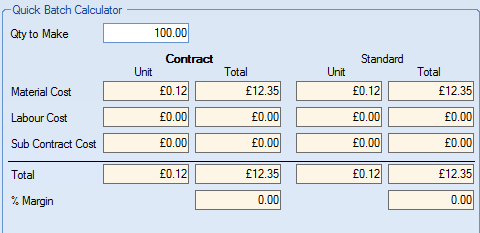

The above example has the Costing Fields set to display 4 decimal places and next example to 2 decimals.

![]()

The system will however still calculate the correct material cost when creating the BOM as shown in the following screen.

In the above example with the number of decimal places set to 2 the Unit cost of this item is displayed as costing £0.12.

In the Qty to Make field it has been decided to manufacture 100 of this item.

The Total cost has reflected that the calculated Unit cost is actually £0.123456 (although displayed as £0.12) each giving a Total of £12.35 when displayed to 2 decimal places.

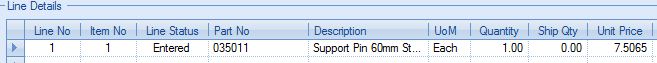

| Quantities | This setting will determine how information regarding quantities is displayed in forms such as the Qty field when creating a BOM in Inventory or the Qty Req field on a purchase order. In the following example the Quantities have been set to 4 decimal places. |

![]()

Bill Of Material

![]()

Purchase Order

| Unit Prices | This setting will determine how information regarding prices is displayed in forms such as the Unit Price field when creating a Sales Order in Customers or the Unit Price field on a Purchase Order. In the following example the Unit Price has been set to 4 decimal places. |

Sales Order

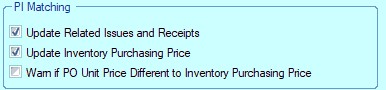

PI Matching options

This section can have a significant bearing on how jobs are costs are calculated and stock valuation reports compiled. This option deals with the way PI Matching (purchase invoice matching) found within the Supplier section of the system operates when applying costs to items bought through the purchasing options of progress plus. The inventory purchasing cost can also be updated directly from PI Matching process is desired.

Example

Purchase Order No.123 is raised to buy a component to be used for Works Order 345

The expected cost of the item being purchased is £10 and this is entered onto the purchase order

The item is then received from the supplier ABC Ltd

If we should run the stock valuation report now, the component would be valued at £10

If we should issue this component to Works Order 345 then the item would now be removed from any stock valuation report but would appear in work in progress reports valued at £10

Later that week the invoice is received from supplier ABC Ltd for the component bought on Purchase Order No.123 but we are being invoiced for £12 though we are happy to pay that amount and the details of the invoice are entered into the PI Matching section with the Suppliers area.

With the Update Related Issues And Receipts option turned off the component would still be valued at £10 if still in stock or if it has already been issued to the works order then the WIP cost would be £10

With the Update Related Issues And Receipts option turned on the component would be valued at £12 if still in stock or if it has already been issued to the works order then the WIP cost would be £12. The Purchasing Cost of the component as displayed in the Inventory section would also be updated to £12 to reflect the last price paid for the item.

With the Update Inventory Prices option unticked, the part's Purchasing Cost value will NOT be updated to the price recorded in the PI Match.

With the Update Inventory Prices option ticked, the part's Purchasing Cost value will be updated to the price recorded in the PI Match.

The Warn If PO Unit Price is Different to Inventory Purchasing Price option is used in conjunction with the Update Inventory Prices option. With this ticked, system will prompt the user prior to update to confirm the update. This allows the user to decide whether the purchasing cost is updated or not.